Cryptocurrency, a digital or virtual form of currency, has revolutionized the financial landscape since the inception of Bitcoin in 2009 by an anonymous entity known as Satoshi Nakamoto. Unlike traditional currencies issued by governments, cryptocurrencies operate on a decentralized platform known as blockchain technology, offering a myriad of advantages and posing unique challenges. This article delves into the nature of digital and decentralized cryptocurrencies, their benefits, and their potential impact on the future of finance.

Understanding Cryptocurrency and Blockchain

Cryptocurrency is a digital asset designed to work as a medium of exchange, utilizing cryptography to secure transactions, control the creation of additional units, and verify asset transfers. The underlying technology behind most cryptocurrencies is the blockchain—a distributed ledger enforced by a network of computers (nodes).

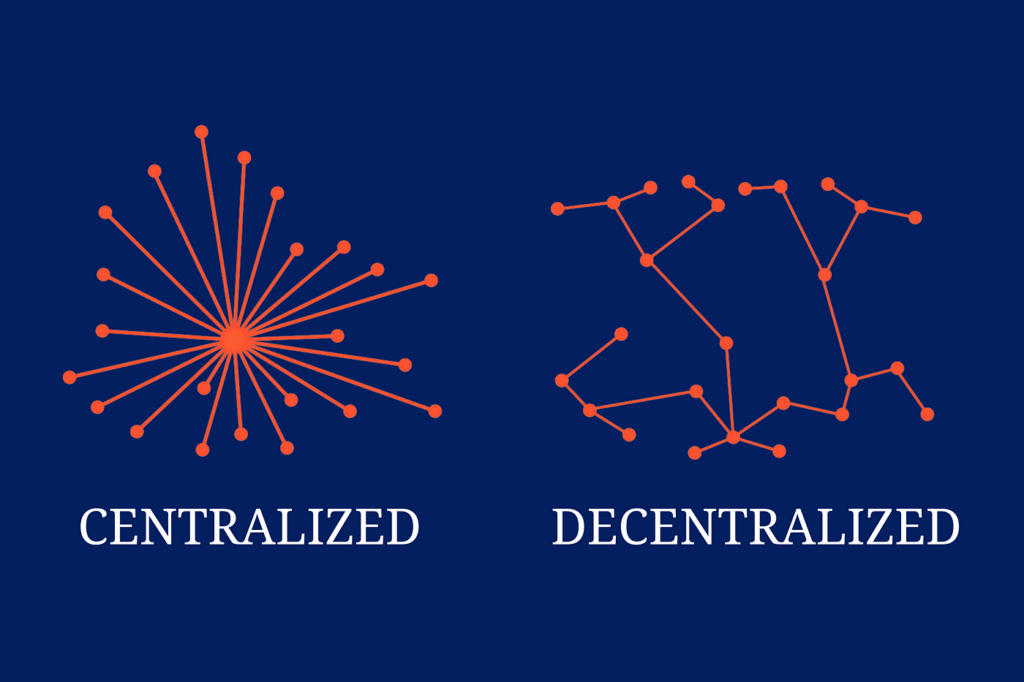

Blockchain Technology: A blockchain is a decentralized digital ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability of data. Each block in the chain contains a number of transactions, and once a block is added to the chain, the information becomes permanent and cannot be altered.

The Decentralization Principle

Decentralization is the cornerstone of cryptocurrency. Traditional financial systems rely on central authorities like banks and governments to manage and regulate currency and transactions. In contrast, cryptocurrencies are typically managed by decentralized networks of computers. This decentralization offers several key benefits:

- Transparency and Trust: All transactions are recorded on a public ledger accessible to anyone. This transparency reduces the likelihood of fraud and enhances trust among users.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. The decentralized nature of blockchain makes it highly resistant to hacking and fraud.

- Lower Transaction Fees: Without intermediaries, transaction costs are significantly reduced. This is particularly beneficial for international transfers, which can be processed quickly and cheaply compared to traditional banking systems.

- Financial Inclusion: Cryptocurrencies provide access to financial services for people without access to traditional banking, especially in developing countries.

Popular Cryptocurrencies

While Bitcoin remains the most well-known cryptocurrency, the market has expanded to include thousands of alternatives (altcoins), each with unique features and purposes. Some notable cryptocurrencies include:

- Ethereum (ETH): Known for its smart contract functionality, allowing developers to build decentralized applications (dApps) on its platform.

- Ripple (XRP): Focused on facilitating real-time, cross-border payment systems.

- Litecoin (LTC): Created as the “silver to Bitcoin’s gold,” offering faster transaction times.

- Cardano (ADA): Emphasizes security, sustainability, and scalability in its blockchain protocol.

Challenges and Risks

Despite its advantages, cryptocurrency faces several challenges:

- Regulatory Uncertainty: Governments worldwide are grappling with how to regulate cryptocurrencies. Regulatory clarity is crucial for wider adoption.

- Volatility: Cryptocurrencies are known for their price volatility, which can be a barrier to their use as a stable medium of exchange.

- Security Concerns: While blockchain technology is secure, the broader ecosystem (exchanges, wallets) can be vulnerable to hacking and theft.

- Environmental Impact: The energy-intensive process of mining cryptocurrencies, particularly Bitcoin, has raised concerns about its environmental sustainability.

The Future of Cryptocurrency

The future of cryptocurrency is a subject of intense debate. Some envision a world where digital currencies coexist with traditional fiat currencies, providing alternative financial solutions and driving innovation in various sectors. Others foresee the potential for certain cryptocurrencies to replace traditional currencies entirely.

Potential Developments:

- Integration with Traditional Finance: Major financial institutions are increasingly exploring blockchain technology and cryptocurrency integration, which could lead to greater adoption and mainstream acceptance.

- Central Bank Digital Currencies (CBDCs): Some governments are developing their digital currencies, leveraging the benefits of blockchain while maintaining central control.

- Technological Advancements: Innovations such as scalability solutions (e.g., Lightning Network for Bitcoin) and improvements in privacy and security features are likely to address some current limitations of cryptocurrencies.

Digital and decentralized cryptocurrencies represent a transformative shift in the financial landscape, offering numerous benefits such as transparency, security, and financial inclusion. However, they also face challenges, including regulatory hurdles, volatility, and environmental concerns. As technology and regulatory frameworks evolve, cryptocurrencies have the potential to redefine the future of finance, offering innovative solutions to age-old problems and opening up new opportunities for individuals and businesses worldwide.